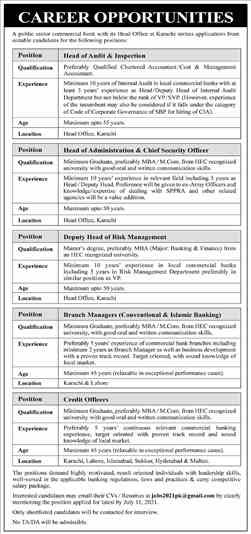

One of the largest and most prestigious commercial banks having a vast nationwide network of branches is looking for dynamic and challenge-oriented professional with proven record of accomplishments in the area of Risk Management.

The individuals who fulfill the below basic-eligibility criteria may apply for the following position:

| Position / Job Title |

Senior Credit Officer - Recovery & Remedial |

| Reporting to |

Chief Credit Officer |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

|

| Experience |

- Minimum 12 years of overall banking / financial institution / credit rating agencies experience with at least 5 years of experience in senior credit risk management and / or recovery & remedial management roles in either business and / or risk and / or restructuring.

- Candidates with international banking experience will be preferred.

- Superior credit risk assessment skills and judgement, including problem recognition, defining and structuring of solutions to complex credit issues. Expertise in remedial management situations. Ability to recognize and address major types of market and operational risks embedded in credit exposures.

- Ability to deal with ambiguity on credit / business issues in reaching a decision, develop solutions / alternatives to difficult credit requests, solicit industry / product expertise as required, manage conflicts and handle unpopular credit decisions.

- Ability to act decisively in time-sensitive situations, exercise good judgment at all times, calmly manage and effectively make decisions in high stress environments.

- Ability to clearly and proactively communicate in verbal and written form to both internal and external clients.

|

| Other Skills / Expertise/ Knowledge Required |

- In depth grasp and understanding of process and drivers to compute expected / unexpected credit losses which includes debt rating models / scorecards / classification / IFRS 9 methodologies, Basel parameters and their implications for loan loss reserves, regulatory / economic capital and stress losses.

- Ability to dimension and frame risk drivers for stress testing.

- Comprehensive knowledge of legal documentation associated with credit / market risk, using examples from portfolio / restructuring / complex credit transactions.

- Enhanced communication skills that reflect an ability to concisely address key issues and provide solutions to senior management and key clients.

- Well conversant in credit policy / risk principles and be seen as respected and credible culture carrier of risk management.

- Ability to demonstrate integrity, independence, leadership, judgment and ability to balance risk and reward.

- To be responsible for individually reviewing and approving credit proposals for recovery and remedial clients, including restructuring & rehabilitation proposals and recommending for approval to the Chief Credit Officer, Chief Risk Officer, Credit Committee and Board of Directors as appropriate.

- To present credit proposals in the credit committee alongside the business as applicable and ensure that all key concerns and issues are addressed rigorously.

- To ensure compliance of credit proposals with RAF, ratings policy, classification and SBP guidelines.

|

| Outline of Main Duties / Responsibilities |

- To be responsible for ensuring consistent and rigorous implementation of portfolio management, risk appetite, early problem recognition, classification policies etc. across the assigned client segments.

- To correspond with SBP on regulatory issues pertaining to credit portfolio of the Bank regarding Commercial and SME clients.

- To ensure consistent ongoing improvement in turn-around-time for credit reviews and proposals while ensuring that all portfolio issues and agreed actions are tracked and executed expeditiously.

- To coordinate, develop, present and implement structured portfolio management & risk appetite frameworks at institutional & sector level ensuring appropriate target market focus and risk appetite.

- To engage broadly in leadership roles in the development of various tools and policy frameworks.

|

| Assessment Interview (s) |

Only shortlisted candidates strictly meeting the above-mentioned basic eligibility criteria will be invited for panel interview (s). |

| Employment Type |

The employment will be on contractual basis, for three years which may be renewed on discretion of the Management. Selected candidates will be offered compensation package and other benefits as per Bank's Policy / rules. |

| Place of Posting |

Karachi |

Interested candidates may visit the website www.sidathyder.com.pk/careers and apply on-line within 10 days from the date of publication of this advertisement as per given instructions.

Application received after due date will not be considered in any case. No TA/DA will be admissible for interview. (We are an equal opportunity employer)